Apple announced its entrance into the finance world back in 2019 with the Apple Card. It’s a Mastercard issued by Goldman Sachs. The Apple Card isn’t all that different from regular credit cards. But it does offer a few benefits that you won’t find elsewhere. Just like with other Apple products, the Apple Card also plays on Apple’s biggest strength; Exclusivity. The Apple card is solely for iPhone users, which gives it the most hype. But the question is; Is the Apple Card the right choice for you? Should you make space in your wallet for it?

Here’s what you need to know about the Apple Card!

Table of contents

Apple Card Review: Pros

Instant Access

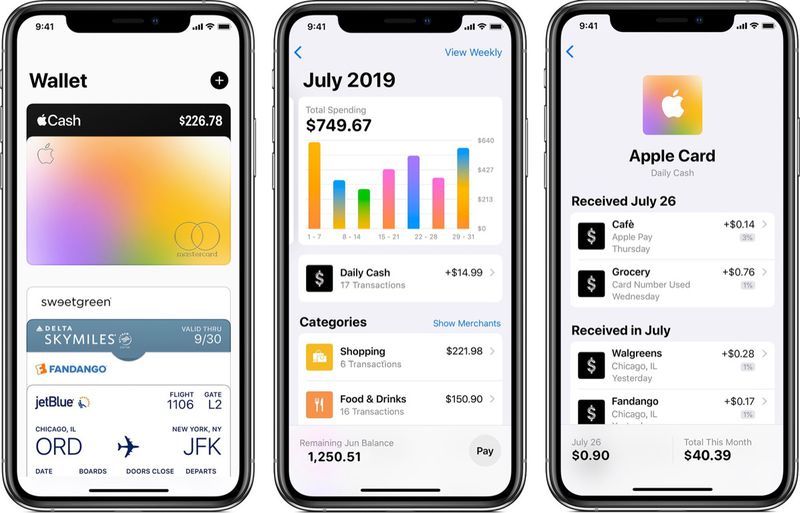

A positive that many Apple users swear by is that you can instantly use the Apple Card. It only takes minutes to apply for the Apple Card from your iPhone through the Wallet app. And the approval process is just as fast. Once you get approved, you can start using your Apple Card instantly. You won’t have to wait a week or more to access your card. This is unlike other credit cards, where you have to wait seven to ten business days for approval and even longer to actually get the card. Another great thing is that you get daily cashback. This means you can use your rewards as you get them.

1%–3% Cash Rebates

Now onto the actual rewards! Apple calls its cashback program the ‘Daily Cash,’ which is exactly what it sounds like. You can earn a set percentage of your purchases back every day. Your daily rebates are deposited instantly into your Apple Card to use again. How much you get back depends on what you buy and how you pay for it. Similar to other credit cards, the Apple Card has three tiers of rewards;

3% Cashback: Applies to purchases made at Apple.com, Apple stores, the App Store, and select brands.

2% Cashback: Applies to all purchases made with Apple Pay.

1% Cashback: Applies to purchases made with the physical Apple Card.

No Fees

One of the biggest pain points consumers have with regular credit cards is too many fees. Apple boasts a ‘No fees’ policy. That means you won’t have to pay anything extra to use your Apple Card. No annual fees. No international transaction fees. And certainly, no late payment fees. Banks and credit card companies have harassed their customers for years with their numerous fees and penalties. Things are taking a turn for the better, with many companies dropping their excessive fee policies. But Apple is the first one to introduce a brand new card with no fees at all. If this isn’t a reason to love the Apple card, then what is?

Installments

With the Apple Card in hand, you can make your Apple purchases even more easily. The Apple Card allows you to buy anything from Apple and pay it off in installments. These installments have no interest, which is a big win since iPhone prices keep climbing up. All you have to do is select Apple Card Monthly Installments when buying from an Apple Store or from Apple.com. This is Apple’s first entry into the Buy Now, Pay Later world, which was soon followed up by Apple Pay Later in iOS 16. Typical periods for Apple Card Monthly Installments range from six months to two years.

Numberless Titanium Card

To finish off our list of pros, we’re going to go with the sleek design of the Apple Card. If you like having fancy credit cards, the Apple Card is one you cannot miss out on. The Apple Card is one of the unique credit cards you’ll find on the market. It’s entirely made of titanium. It’s completely silver in color and has minimal text and logo, which adds a mysterious and edgy element to it. Your name is laser etched onto the card. On the front side, you’ll only find the Apple logo, a built-in chip and your name. On the backside, there’s the Goldman Sachs logo and a traditional magstripe. And that’s pretty much it. No number, no CVV. This means nobody other than you can use it for online purchases if you lose the card. Have a look at this beautiful masterpiece!

Apple Card Review: Cons

Limited Acceptance

One of the first negatives of the Apple Card is its limited acceptance. Apple Pay has become quite popular since its launch. But it’s still quite limited if you look at how large the American consumer market is. Most large retailers still don’t accept Apple Pay. Walmart has its own payment system, so there’s no way it’ll give its precious customers over to Apple. While Costco does accept Apple Pay, it only takes Visa cards. Unfortunately, the Apple Card runs on the Mastercard network. Here’s another example! You can only use Apple Pay at Starbucks to reload your Starbucks Card. So the Apple Card is useless there too.

Apple Dependency

The Apple Card was launched solely with Apple users in mind. That means if you don’t have an iPhone, you won’t be able to use the Apple Card. Additionally, your iPhone needs to be running on iOS 15.1.1 or later to even use the card. Well, that’s a little disappointing to hear for Android users and people with older iPhone models. If you’re committed to a different wallet, such as Samsung Pay or Google Pay, you might want to stick to regular credit cards.

Low Cashback on Non-Apple Pay Purchases

Do you buy everything you need with Apple Pay? Who does, right? Everybody has a preferred way of paying for different expenses. Sometimes you use your credit card; other times, you’ll use Apple Pay. Or simply with cash. But the Apple Card might not be a good fit for you if that’s the case. Apple Card has a very limited set of benefits for non-Apple Pay purchases. For all non-Apple Pay payments, you’ll earn a 1% daily cashback. The cashback is way too low. It almost seems like a ploy to get people to switch over to Apple Pay.

How to Earn Cashback?

The biggest question people have on their minds is; How do I earn my cashback? Well, it isn’t that much different from other credit cards. You simply make payments with your Apple Card. And you’ll get your rewards according to the tiers we mentioned above. It’s important to get into a little more detail here about the tiers.

The first tier earns you the most cashback. Obviously, Apple is going to put its own products here in this tier. They do have to market themselves too. All purchases from Apple made with Apple Pay will earn you 3% cashback. This includes the App Store and Apple services as well. It’s not over yet. Apple has added more brands and retailers in this tier over the years, and it’s become quite vast now. For example, all Nike purchases made with Apple Pay, in-store or online, fall in the same category.

Other brands and retailers include:

- Uber and Uber Eats

- In-store T-Mobile purchases

- Walgreens and Duane Reade

- Exxon and Mobil gas station purchases via Apple Pay

All other purchases with Apple Pay fall within the second tier, which nets you a 2% cashback. The third tier is for any purchases made with the physical Apple Card, i.e., 1% cashback.

How to See Your Daily Cash Rewards?

After every purchase with the Apple Card, you instantly receive your cashback rewards, whichever category they may fall into. You can view them in the Wallet app on your iPhone. Here’s how:

- Open the Wallet app on your iPhone.

- Tap on the Apple Card.

- Click on Monthly Activity or Weekly Activity.

- You’ll find a list of your transactions by date.

- Tap on Daily Cash.

- The next screen will show you how much cashback you earned for each of those transactions.

You can also use the same method to check your transactions for the Apple Cash card. Just tap on the Apple Cash card on the homepage of the Wallet app. The rest of the procedure is the same as above.

Rates and Fees

On towards the costs of the Apple Card! As it goes with any credit card, the holder’s income, credit score and history matter a lot. The Apple Card also has a variable APR. The minimum APR is 13.24%, while the maximum is 24.24%. It does seem like a reasonable rate, especially for low-credit holders.

As we mentioned above, the Apple card has no fees, which is one of its most attractive features. You can use it internationally and it won’t cost you extra. Or forget to make a payment and incur no penalties. Obviously, we don’t recommend you miss any of your payments. Apple still reports your credit activity to all three credit bureaus, so it will affect your credit score.

But the Apple Card does have some limits. Again, the credit limits for each cardholder will be dependent on their income level and credit history. Some cardholders have reported a limit as low as $50, while others have reported limits as lax as $15,000.

Family Sharing

Before we reach the end of our review, there’s one feature we’d like to talk about individually. And that is the Apple Card Family Sharing feature. Just last year, Apple unveiled this new feature that has gained quite a lot of popularity.

Apple now allows upto five people to be added to a single Apple Card account. That means spouses can be co-owners of an Apple Card and help each other build credit. Parents can share their cards with children to help them make daily purchases. To help out parents, Apple has added parental controls such as spending limits. This is a great initiative to help children learn about financial literacy from a young age.

All sharing is handled through the Wallet app. A single bill tracks the entire family’s spending. Children must be 13 years of age or above to be added to the Family Sharing group. Whereas co-owners need to be 18 or above. Existing Apple Card owners can also merge their accounts if they already have two cards. This will give them the higher credit limit and the lower APR of the two.

Who Qualifies for the Apple Card?

To qualify for the Apple Card, you need to be 18 years of age or older. You also need to be a lawful US resident or citizen with a US address. But the most important factor here is that you must have an iPhone. And not just any iPhone, but one that’s running on iOS 15. So if you have an Android or an older iPhone, it might be better to stick to regular credit cards. You’ll have to turn on two-factor authentication and sync your iCloud account to apply for the Apple Card.

Apple has tried to make the Apple Card as accessible as possible, which means lax credit requirements. Goldman Sachs has been reported to have approved applicants with scores around 600 as well. A hard check happens when you apply for an Apple Card.

How to Apply for an Apple Card?

Applying for the Apple Card is very simple. It’s a straightforward process that all happens from the Wallet app on your iPhone. Here’s what you need to do:

- Open the Wallet App.

- Tap on the Plus sign.

- Select Apple Card.

- Click on Continue.

- Agree to the Terms and Conditions.

- Accept the offered credit limit and APR.

When you apply for the Apple Card, most of your personal information will be pre-filled based on your Apple ID. All you need to do is fill in your income information. Once you’ve applied, your application will be sent to Goldman Sachs for review.

Apple Card Review: Final Verdict

The Apple Card still has a long way to go to compete with other credit cards from traditional banks and credit agencies. The best rewards are limited to Apple purchases only. And the categories are quite restricted. Maybe Apple could add more benefits for grocery, travel or accommodations. But the low fees, lax credit requirements and Family Sharing features are all great. So if you have an iPhone and are an avid Apple Pay user, the Apple Card might just be the right choice for you.

Have you used the Apple Card? How did you like it? Let us know in the comments below!