The NFT market is less than five years old, but its popularity and price hike have been remarkable. The word NFT became the word of the year in 2021, chosen by Collins Dictionary. NFTs are evolving the way content is being created and monetized. Tech-savvy geeks obsess over these non-tangible objects, and a huge sum of capital is being invested in NFTs. Even the official edition of the United States constitution was sold as an NFT for $43,173,000.

Previously, digital creators and artists suffered at the hands of publishers and auction houses. Now the NFT platform has eliminated the need for a middle man, providing the buyer and the creators an opportunity to trade directly. NFTs have the potential to shift the creator economy by giving more autonomy to the creators over their work.

In this article, we will discuss the importance of NFT as an asset.

Table of contents

What Is NFT?

A non-fungible token (NFT) is like data that cannot be interchanged. The ownership of NFTs can be transferred from one person to another through transactions on a blockchain. Simply, NFTs are tradable ownership rights to anything that can be digitally created, such as images, videos, docs etc. OpenSea and Axie Marketplace are some of the common marketplaces for NFTs where the traders can even exchange real property rights represented through NFTs.

NFTs are stored on the blockchain–Ethereum, Solana, Tezos etc., in the form of time-series data. This non-interchangeable data is encoded with unique identifiers that are used as proof of ownership. So when a person buys an NFT, they simply buy the ownership rights to that asset.

NFTs are only transferable and cannot be exchanged, which means that they are one of a kind. For example, a bag containing 100 grams of rice can be exchanged for two bags containing fifty grams of rice. But this cannot be done with NFTs.

Simply an NFT can be assumed as a handwritten book by the writer. There can be dozens of copies and thousands of pirated copies of that book. Some printers might change the cover page of the book or add additional notes to it. But the original written copy remains authentic.

An NFT can be copied, and its other versions can be created, but only the creator and the buyer have the ownership rights. It’s like a friend borrows a coffee mug from you every day in the morning and drinks coffee in it, but the coffee mug is yours because you are the owner of it.

NFTs are published on the blockchain through a process called minting. The code that proves the ownership of an NFT is called a smart contract. Once the NFT is published on a blockchain, it can be sold or purchased.

When someone purchases an NFT, they run a code in the form of a smart contract. It is verified through nodes on the blockchain network. Once the ownership is proved, the nodes add a new block to the blockchain. The unique identifiers in the smart contract prove that a certain entity owns a particular NFT.

Why Do People Buy NFT?

NFTs have commodified digital objects and have turned them into assets that can be purchased through cryptocurrency. In economic terms, an asset is anything that has a capital value that increases over time due to inflation of high demand. Let’s suppose you bought gold worth $3000. When the market value of gold increases, you can sell it for a higher price.

NFT serves as a digital market for products that exist in real-time or digitally. But the speculations are unprecedented. The price of NFT bought for 200 ETH might flip to 7ETH next morning; the uncertainty is always there. Different buyers buy NFTs for different reasons. The buyers can be collectors of digital art or flippers who buy NFTs just to resale them. The resale of NFTs is called secondary sales.

NFTs have changed the way people see digital art, providing an opportunity for creators to monetize their work. This novel domain of assets has mesmerized the consumers because of its promising future and the way it is transparently distributed and marketed. People are buying NFTs because of their popularity, and they hope that their value will increase over time.

The long-term holders prefer to buy one-on-one NFTs that are exclusive or limited edition. Holders collect these rare NFTs for a long time, either for collection or resale in the future. However, the resellers are more focused on buying NFTs that can be resold at a higher price as quickly as possible.

NFTs are gaining popularity among obsessive collectors because they provide a unique connection to the creator and access to an exclusive crypto community. The speculation in NFTs has also risen due to the social media hype. Tech giants and major brands such as Coca-Cola and Team GB have incorporated NFTs in their branding models, ultimately adding to the hype.

The trend of buying, owning and creating NFTs has certainly increased. The transparent transaction and buyer history available on the blockchain have made NFTs more attractive. By the end of 2021, NFT had 1,722,714 owners with an average holding time of 30-40 days.

Another reason for this boom in the speculations is that GenZ does not find the conventional economic models accommodating enough to cater to their needs. Their concept of assets and investment is different from the traditional notions. There is a lack of trust among GenZ regarding conventional assets such as real estate or bonds etc. Their concept of valuable assets is technology-centered. Having greater control over their personalized digital experience has made them more likely to adopt and prefer digital assets.

How Are NFTs Monetized?

NFTs are monetized in the form of social tokens, digital memorabilia, tickets, pdf, website domains and game tokens. The key component of the monetization of NFTs is digital scarcity. Blockchain technology allows creators to enforce restrictions regarding where their content can be shared or used. These restrictions are imposed on NFTs by means of their storage.

New technologies have been introduced to store NFTs as private assets. NFTs can be stored in offline wallets or digital vaults where no other person except the owner can access them. They can also be stored in internet-connected wallets where people can view and make copies of them.

An interesting part about NFT is that every time it’s sold, a percentage share goes to the creator. This has allowed artists to generate profit from their artwork. The value of NFT is directly associated with the hype it receives from the population. For example, the popularity of the Bored Ape Yacht Club NFT has been attributed to its famous owners like Eminem, Post Malone and Justin Bieber.

The NFTs are usually launched in the form of collections. The items in the collection are mostly related to each other; however, the collections can be different, such as collectible cards, utilities for Metaverse, game tokens etc.

Such exclusive NFTs can be treated as invitations to members-only parties, merchandise and special events. NFT creators can build a brand around that NFT to generate revenue. A community can be engaged around the NFTs, which increases its value.

Research shows that the price of an NFT in a collection is positively correlated to the price of other NFT sold from the same collection. More than half of the variations in future primary and secondary sale prices of NFTs can be predicted from the median sale price of NFTs in that collection.

The NFT itself might seem a bit absurd, but the community built around it makes it on demand. NFT communities are digitally interconnected that provide marketing opportunities and exposure to artists. Now, the NFTs are also being rented so others can enjoy the member benefits. The digital scarcity of exclusive NFTs and their marketing in digital spaces create hype around them. The monetization can be done in various ways, and we need an innovative approach to utilize NFTs to gain maximum revenue from them.

An optimistic approach to this is that NFTs can bring people from different walks of life together to solve the humanitarian crisis. The more ambitious or impactful the community around an NFT will be, the more capital value and hype it will gain. For example, Stella Artois released an NFT collection to engage the community in order to solve the water crisis. This is how NFTs were used to raise awareness for almost two billion people who don’t have access to adequate and safe drinking water.

How do Market Forces determine the Value of NFT?

Not all NFTs are treated equally; a major portion of their popularity comes from luck and marketing. Brands can create their own NFTs through which the owners can receive special discounts or exclusive products. However, the NFT can also lose value if the added value is not desirable to the customers or if the creator runs out of luck.

Determining the value of these assets is not easy because the variations in the price of cryptocurrency impact the value of NFTs. The value of an NFT might be higher in terms of cryptocurrency, but the value of the cryptocurrency might fall in the dollar market. Hence, predicting the price of NFT is really difficult. Unless you run complicated regression models by taking multiple variables into account to predict the price. However, the spillover effect created by the volatility of cryptocurrency has a lower impact on the price of NFTs.

The value of NFTs also varies according to their category. Ironically, the assets with little to no utility are prized the most, and their prize is the hardest to predict. The NFTs are usually priced higher because of their hedonistic value, such as the work of the artist, attachment to a digital possession or connection with a favorite singer.

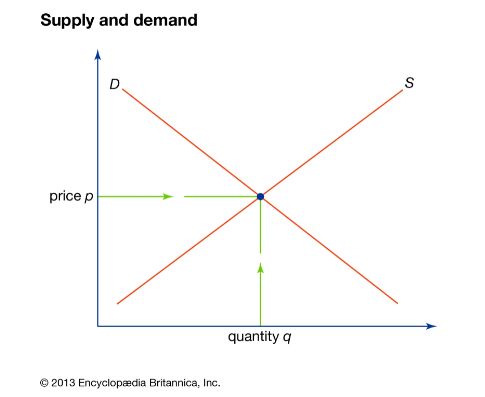

However, the value of some NFTs does not follow the supply and demand curve, such as art or game tokens. These NFTs are Veblen Goods as their demand rises due to their higher price. In the case of Veblen goods, the price of the asset is positively correlated to their demand.

The high price is mostly attributed to the perception of high quality and the ways through which NFTs are marketed and distributed. The high quality in terms of NFT is related to the exclusive offers and the community around that NFT. These communities give the buyers a chance to become a part of a famous people’s crowd.

Market manipulation also creates an unrealistic price bubble in the NFT market. The price can also shoot up or go down due to unrealistic bidding by bots. Moreover, the market value can be biased as major brands such as Coca-cola have entered the NFT market. These trends can cause the issue of over-speculation, which leads to a price hike. When the NFTs are sold at unrealistically high prices, their secondary sale increases. This creates more buyers in the market. According to nonfungible.com, the number of sellers has increased from 31.7 thousand in 2020 to 1.2 million in 2021.

Economists also suggest that a boom in the NFT is fragile. The bubble will soon burst as more creators enter the market. As the market of NFTs gets more saturated, the chances of NFT devaluation increase. Currently, there are 15,719,929 NFT creators in the market.

Creating an NFT is easier than purchasing it. You can simply put a pink dot on a white background and list it as an NFT. The number of creators is outpacing the number of buyers, which is creating a financial bubble. The market competitiveness has increased, which encourages the NFT creators to engage the community around an NFT.

NFTs are here to stay because of their diverse nature and transparency. Moreover, they satisfy the financial and social needs of creators and collectors of digital assets through community building, serving as an origin to a new dimension of assets.

However, the development of the NFT ecosystem is still in its initial stage, and the technology is evolving through which these tokens can be fully monetized. The virtual aspect of NFTs makes them vulnerable to cybersecurity threats.

The risk of losing the speculations still persists as the market value is uncertain. The floor price of NFT collectibles does not reflect their actual market value, and building merchandise around them is not easy.

Parting Words

The issues regarding copyright implementation create a lot of uncertainty as a business prospect as well, but tech enthusiasts are very hopeful. NFTs do not provide exposure to all the artists and buyers, only to the ones that know how to trade them. The need is to demystify NFTs by educating people about different aspects of them. Regulations should be made to prevent artificial speculation and to ensure the authenticity of NFTs.